Fidelity about to file its own bitcoin ETF, following BlackRock’s application

Major asset manager Fidelity is preparing to submit its own application for a spot bitcoin exchange-traded fund (ETF), joining other big money asset managers such as BlackRock.

BlackRock had recently submitted its own spot bitcoin exchange-traded fund on the 15th of June, sparking considerable interest from other asset managers.

With its spot bitcoin exchange-traded fund, Fidelity will join a growing list of institutions that are competing to be the first to introduce and get approval for a spot bitcoin exchange-traded fund. The filing sees Fidelity follow BlackRock, the world’s largest asset manager, in filing for an ETF.

According to reports, Fidelity’s application could be filed as soon as this week and would be Fidelity’s second attempt at launching a spot bitcoin ETF. Fidelity also filed an application in 2022 but failed to get approval from the United States Securities and Exchange Commission (SEC).

Source: CryptoDaily

Bitcoin miners send record $128M in revenue to exchanges

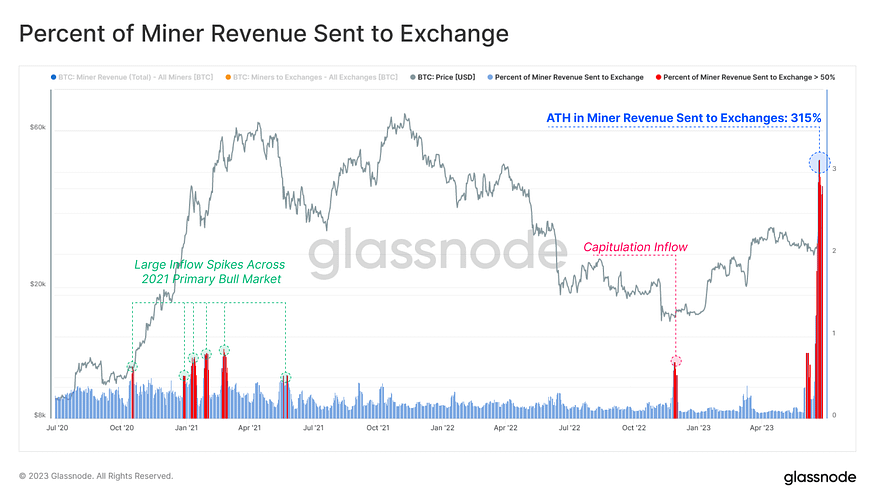

Bitcoin miners are sending record amounts of BTC to centralized crypto exchanges. In a June 27 tweet, on-chain analytics platform Glassnode reported an all-time high in Bitcoin miner revenue sent to exchanges.

It noted that there was currently an “extremely high exchange interaction,” from Bitcoin miners which had sent a record $128 million to exchanges over the past week. This is equivalent to 315% of their daily revenue, the analytics platform noted.

Bitfinex launches innovative P2P platform ‘Bitfinex P2P’ in Latin America

Bitfinex, one of the first crypto exchanges, is making significant strides in Latin America with the launch of its peer-to-peer (P2P) platform, Bitfinex P2P.

The platform aims to provide financial freedom and inclusion to Venezuela, Argentina, and Colombia users. By directly facilitating the buying and selling of cryptocurrencies such as Bitcoin (BTC), Ether (ETH), Tether tokens (USDt and EURt), and Tether Gold (XAUt), Bitfinex P2P empowers customers to engage with the marketplace in a convenient and secure manner.

The launch of Bitfinex P2P represents a strategic move by Bitfinex to expand access to digital asset-related financial services in Latin America. This follows the company’s recent investment in Chilean “cryptobank” OrionX and its active involvement in El Salvador, where Bitcoin has been adopted as legal tender.

Source: Cryptopolitan